Unlock Fintech Innovation: Practical Tutorials and Best Tools for App Builders

From Code to Cash: Hands-On Guide to Fintech App Development Tutorials and Tools

Hands-On Fintech App Development: Essential Tutorials and Top Tools for 2025

- Did you know that fintech apps like Chime and Robinhood have disrupted traditional banking, serving millions and generating billions in revenue?

- Imagine building your own app that streamlines payments or investments – turning everyday finance into seamless experiences.

- What if a single tutorial could launch your career in one of the fastest-growing industries, valued at over $300 billion globally?

Introduction

In today's fast-paced digital world, financial technology for business is transforming how companies manage money, engage customers, and drive growth. Fintech app development isn't just for tech giants; it's accessible to entrepreneurs, developers, and businesses looking to innovate. This article dives deep into hands-on tutorials and the best tools to get you started.

You'll learn practical steps to build secure, user-friendly apps, explore real-world examples, and gain insights from recent market trends. By the end, you'll have the knowledge to create fintech solutions that boost efficiency and profitability in your business.

Financial technology for business empowers organizations to adopt agile, tech-driven strategies. Whether you're a startup founder or a corporate leader, mastering fintech app development can give you a competitive edge. Let's explore how to turn ideas into functional apps.

Understanding Fintech App Development

Fintech app development involves creating software that merges finance with technology to deliver services like mobile banking, payments, and investments. It's a core part of financial technology for business, enabling companies to offer digital solutions that traditional banks can't match.

These apps handle sensitive data, so security is paramount. Developers focus on compliance with regulations like GDPR and PCI-DSS. Fintech software development services often include custom integrations for seamless operations.

For businesses, fintech app development means faster transactions and better customer experiences. It's not just coding; it's about solving real financial problems.

Why Fintech Matters for Businesses Today

Financial technology for business streamlines operations, reduces costs, and opens new revenue streams. Apps can automate accounting or provide instant loans, boosting efficiency.

According to recent data, fintech adoption has surged, with over 70% of consumers using digital banking. This shift highlights the need for robust fintech app development.

Businesses leveraging fintech see improved scalability. For instance, integrating AI in apps predicts cash flow, aiding decision-making.

Key Trends in Fintech for 2025

The fintech landscape is evolving rapidly. In 2025, AI and blockchain dominate, as per reports from KPMG and BCG. Fintech revenues grew 21% year-over-year, outpacing traditional finance.

AI in fintech is worth $30 billion this year, projected to reach $83.1 billion by 2030. This implies businesses can use AI for personalized services, like fraud detection or investment advice.

Stablecoins and embedded finance are gaining traction amid regulatory advancements. These trends mean fintech app development must incorporate crypto integrations for modern users.

Fintech buyers are acquiring startups, signaling consolidation. For developers, this creates opportunities in scalable app designs.

Market Statistics and Implications

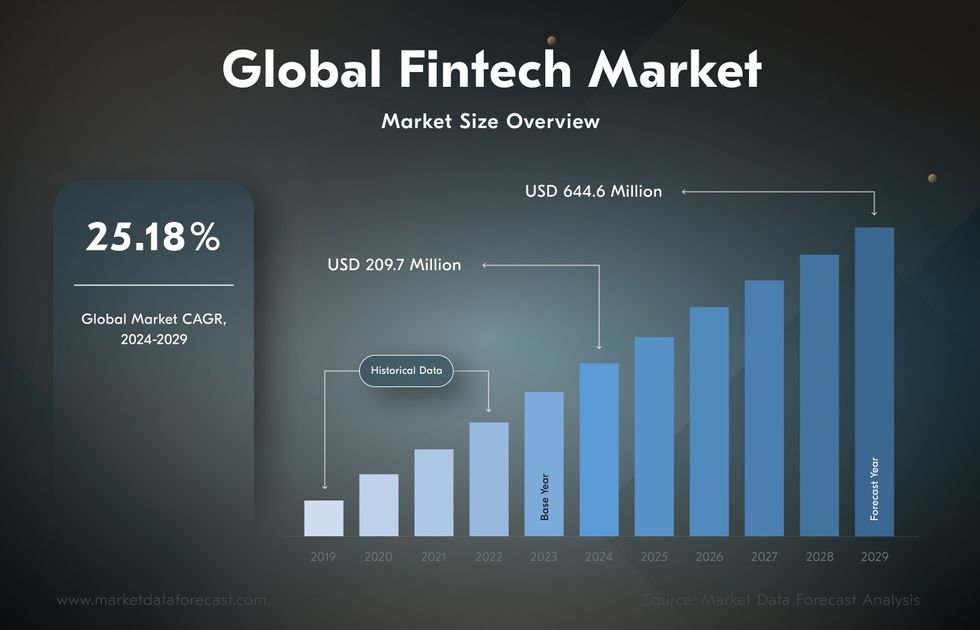

The global fintech market is set to grow at 25.18% CAGR from 2025 to 2033, reaching USD 1,583.05 billion. This growth underscores the demand for innovative financial technology for business.

Blockchain heads mainstream, with regulators increasing pressure. Businesses must adapt to avoid compliance pitfalls.

AI's transformative power is evident in generative tools for banking. These stats imply a shift toward tech-savvy financial solutions.

Fintech investors are selective, focusing on later-stage deals. This means solid fintech app development can attract funding.

Sustainable banking and digital wallets are key trends. Developers should prioritize eco-friendly features.

Here's a quick comparison of growth areas:

| Technology | 2025 Value (USD Billion) | Projected 2030 Value (USD Billion) |

|---|---|---|

| AI | 30 | 83.1 |

| Blockchain | Varies | Significant growth |

| Stablecoins | Emerging | High adoption |

These figures highlight why financial technology for business is crucial now.

Essential Tools for Fintech Software Development Services

Choosing the right tools is key in fintech app development. In 2025, stacks like Node.js for backend and React for frontend are popular.

Node.js excels in real-time processing, ideal for payments. Java with Spring Boot suits enterprise apps.

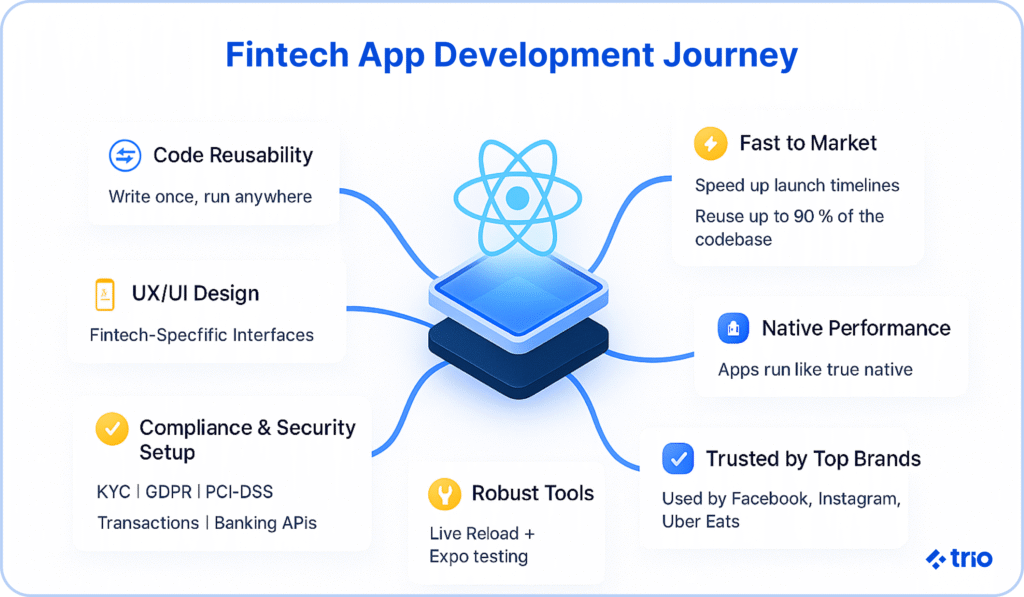

For mobile, Kotlin and Swift are top choices for native development. Cross-platform tools like React Native speed up launches.

Databases like PostgreSQL ensure data integrity. Security tools, including encryption libraries, are non-negotiable.

Fintech software development services often use AWS or Azure for cloud scalability. These tools help build compliant, fast apps.

Top Tools Breakdown

✅ Node.js: Event-driven, great for high-traffic fintech apps.

✅ React: For intuitive UIs in mobile banking.

✅ Spring Boot: Secure backend for financial transactions.

✅ PostgreSQL: Reliable database for user data.

✅ AWS: Cloud services for hosting and AI integrations.

Comparisons show Node.js is faster for startups, while Java offers robustness for large enterprises.

User experiences highlight React's ease: "Switching to React cut our development time by 30%," says a fintech developer.

Step-by-Step Tutorials for Building Fintech Apps

Ready to code? Here's a hands-on tutorial for a basic payment app. Start with defining your MVP.

- Research user needs: Survey potential users for features like transfers.

- Choose stack: Use Node.js backend, React frontend.

- Set up environment: Install Node, create project with npm init.

- Build backend: Create API endpoints for transactions using Express.js.

- Integrate security: Add JWT for authentication.

- Frontend development: Use React to design dashboards.

- Test and deploy: Use Jest for testing, deploy on Heroku.

This tutorial draws from guides emphasizing compliance first.

For AI-powered apps, incorporate TensorFlow for fraud detection. Step: Train model on sample data, integrate via API.

Actionable tip: Use Git for version control to collaborate.

Advanced Tutorial: Integrating Blockchain

Blockchain enhances security in fintech app development.

- Install Web3.js for Ethereum interactions.

- Create smart contracts with Solidity.

- Deploy on testnet like Ropsten.

- Connect frontend: Use MetaMask for wallet links.

This adds decentralized features, popular in 2025 trends.

Challenges include gas fees; optimize code to reduce costs.

A developer testimonial: "Blockchain integration boosted our app's trust factor immensely."

Case Studies: Successful Fintech Implementations

Look at Chime, a neobank app that offers fee-free banking. Through fintech app development, it reached 12 million users by focusing on UX.

Chime used React Native for cross-platform speed, integrating AI for personalized tips. Result: Rapid growth, valued at billions.

Robinhood democratized investing with zero-commission trades. Its fintech software development services included real-time data APIs.

A case study shows Robinhood's app scaled during market volatility, handling millions of trades.

In insurance, companies like Lemonade use AI for instant claims. This financial technology for business reduced processing time from days to seconds.

Spendesk, a fintech unicorn, enabled SEPA payments via app integrations. Their MVP focused on user pain points, leading to unicorn status.

User experience: "Lemonade's app made insurance hassle-free," shares a policyholder.

Comparisons: Traditional banks vs. fintech apps show 40% faster services in fintech.

These examples illustrate how fintech pr (public relations) amplifies success through viral features.

Expanding on Challenges in Case Studies

Fintech startups face scalability issues. Chime overcame this with cloud migration, handling peak loads.

Regulatory hurdles: Robinhood navigated SEC rules by embedding compliance early.

Future trends: These apps are integrating Web3 for decentralized finance.

Statistics: Fintech firms cut burn rates, improving profitability.

Practical tip: Start with MVP, iterate based on user feedback.

Challenges and Best Practices in Fintech App Development

Fintech app development comes with hurdles like security breaches and compliance. Cyber threats are rising, demanding robust encryption.

Regulatory compliance varies by region; non-adherence can lead to fines.

Scalability: Apps must handle growing users without crashes.

Data privacy: With GDPR, protect user info at all costs.

Building trust: Users hesitate with new apps; transparent fintech pr helps.

Overcoming Challenges with Best Practices

Implement security-first DevOps. Use multi-factor authentication and regular audits.

For compliance, consult experts early in fintech software development services.

Scalability tip: Design microservices architecture.

Best practice: Secure-by-design principles.

Actionable steps:

- Conduct threat modeling.

- Integrate KYC/AML tools.

- Test for vulnerabilities.

User testimonials: "Adopting these practices reduced our risks by 50%."

Comparisons: Native vs. cross-platform – native offers better security for fintech.

Future trends: Quantum-resistant encryption to counter emerging threats.

An additional paragraph on reviews: Users praise apps like Monzo for intuitive designs, but criticize others for slow support. Comparisons show Chime excels in fees, while Robinhood leads in trading UX. Developer experiences highlight the need for agile methods in fintech app development.

Conclusion

We've covered fintech app development from trends to tutorials, tools, case studies, and best practices. Financial technology for business is key to innovation, with AI and blockchain leading the way.

Apply these insights to build your app. Share your thoughts in the comments or spread this guide – let's discuss your fintech ideas!

FAQ (Frequently Asked Questions)

Q: What is the cost of fintech app development? A: It varies from $50,000 to $300,000, depending on features and complexity. Start with an MVP to control costs.

Q: How long does it take to build a fintech app? A: Typically 4-12 months, including planning, development, and testing phases.

Q: What skills are needed for fintech software development services? A: Proficiency in programming languages like JavaScript, knowledge of security protocols, and understanding of financial regulations.